10 Reasons You Should Choose a 15-Year Mortgage

- Eric Bowie

- Feb 8, 2021

- 7 min read

Updated: Feb 9, 2021

This blog post contains affiliate links that we trust. If you use these links to buy something we may earn a commission, at no cost to you. Read our full disclaimer policy here. Thanks

I have often heard that the number one golden rule of money is to “think long-term”. Well, when it comes to a mortgage, we should probably say "think long-term while paying in the short term".

Table of Contents

When it comes to buying a home, a 15-year mortgage will cost you an extra few hundred a month in the short term, but over the long haul, that will turn into hundreds of thousands of dollars of savings.

Trust me, I did not take this same advice and I am kicking myself for that mistake. Had I taken heed of this advice about 16 years ago and purchased my home on a 15-year mortgage, I would currently be living in a paid for home. So that YOU do not make the same mistake I made, please read on.

In this article, I will lay out the 10 reasons why you should choose a 15-year mortgage over a 30-year mortgage, for the sake of your long-term money goals.

Before I get to the 10 reasons why you should choose a 15-year mortgage over a 30-year mortgage, for the sake of your long-term money goals, let me address two important things:

First, if you get a 30-year note and invest the difference of what you would be paying on a 15-year note, you very well will come out ahead. The actual numbers prove this. But the likelihood and chances of life not getting in the way of you doing that, is slim. Most people do not have that kind of discipline, and things always come up.

Secondly, if you get a 30-year mortgage and just pay extra on the house each year, you can pay down your house basically as fast as if you had a 15-year mortgage. This may allow you to lower the risks associated with a higher monthly mortgage. But, again, the likelihood of you doing that without life getting in the way, is miniscule.

The fact is that things do come up. So, if you are not obligated to pay a 15-year note on your home, then the chances of you following through with paying extra on your mortgage or investing the difference, is unlikely. Life is lived in real time, not on an amortization table.

There will be Christmas gifts, vacations, proms, teenagers wanting cars, school supplies, new furniture, and many more things that will prevent you from that perfect plan on paper to pay extra on your home.

With that said, here are 10 reasons why you should choose a 15-year mortgage over a 30-year mortgage, for the sake of your long-term money goals.

1. 15-year mortgages are much less costly

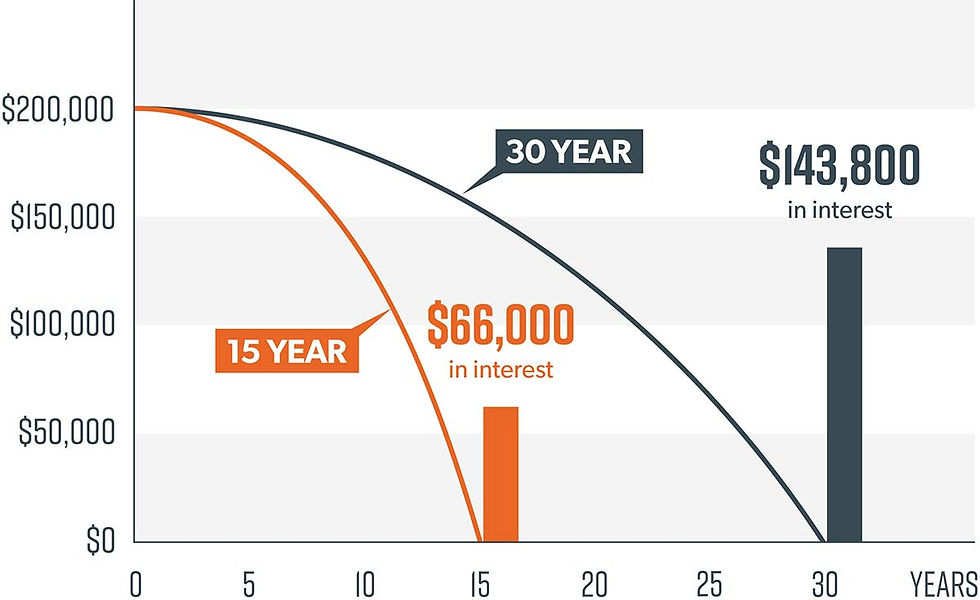

As you can see from the graph below: a modest $200K loan with a 4% interest will force you to pay well over twice as much in interest payments. If we bump this to a $400K loan with a 2% interest, you will pay nearly a whopping 3 times more in interest over the course of 30 years.

Photo courtesy of www.chrishogan360.com

2. More risks, but more reward

Risks are always present and there are different levels to the whole conversation about risks. The only thing that changes is who assumes those risks. A 15-year mortgage reduces the risks to the bank, which is why the interest rate is lowered. A 30-year mortgage, while more risks to you, also lowers your payments.

However, the chances, that you will default on a 30-year loan with a lower principal and interest payment, is also a potentially reduction in the amount of risks to a lender.

Again, there are different levels to risks and different aspects of these loans carries different sets of risks to both the borrower and the lender. Without going into a detailed discussion of risks, just keep in mind that risks are present, and they make a difference.

3. Less predictable, but greater reward

For most, the 15-year mortgage is a little less safe, in the beginning, due to the higher monthly premium. Are 15-year mortgages a bit of a stretch for some? Yes, initially.

However, as you age, your purchasing power should increase, and the affordability of a 15-year mortgage changes, as you grow, earn more, and your income increases.

4. Lower interest rate

The incentive of the lower interest rate makes a difference and can make the 15-year mortgage more attractive. One of the reasons you are paying much less interest over time with a 15-year mortgage, is the fact that you have a slightly lower interest rate.

Right now, interest rates are at an all-time low, and to get the lowest possible interest rate, you must latch on to the 15-year mortgage.

Photo courtesy of www.washingtonpost.com

5. Dispel the tax argument because It is not worth it

Yes, you get a bigger tax deduction with a longer term for your mortgage, but do not let that fool you. With a 30-year mortgage, you pay much more in interest each year so that you can send the IRS a fraction less each year. The numbers do not make the incentive worth it.

Is it a good idea to keep a mortgage around for 30 years to get that tax deduction? Not really. Click HERE to check out an article that breaks the numbers down for you.

6. Equity grows faster

In the first 10 years of a 30-year mortgage you can plan on growing little equity. In fact, the traction you get on equity in miniscule on a 30-year loan because the vast amount of your monthly payments is paying interest.

With a 15-year mortgage your equity is really kicking in much faster. The quicker you build equity in your home, the more options you have.

Our case:

In 2005 we purchased my modest home for $187K. We had $5,000 to put down and I got it on an 80/20 loan. Which means we had two mortgages. One was for 80% of the financed amount at around 6% interest, and the other was for 20% of the financed amount at around 9%. Go ahead and call me stupid. We ended up keeping this poorly structured loan until 2014 when we finally refinanced into one fixed-priced 15-year mortgage with a much lower rate.

From 2005 to 2014, we paid down the mortgage by roughly $9,000. That is only a $9,000 principal reduction in 9 years! However, from 2014 to the end of 2020, we paid the mortgage down by $55,000. That is a $55,000 reduction in the principal in only 6 years.

That huge difference came by us simply converting to a 15-year mortgage. Yes, the amount of the monthly payment increased by $250, but it was well worth it when I count the cost of the equity we have accrued. Not to mention, instead of paying the home off in 2035, it will be paid off in 2029.

I would have saved myself much more money if I had originally put the home on a 15-year mortgage. Lesson learned.

Sign up to get our latest blog posts FREE!

7. Less likely to overborrow

With a 30-year mortgage, there is greater potential to borrow more than you should. Lower payments mean you will qualify for more house and therefore the bank will tell you that you "qualify" for a larger amount. This is tempting.

This can be a curse if you are not disciplined enough to be conservative in your home buying purchase. Smaller payments make more buyers eligible for homes they otherwise would not be eligible for, if the monthly payments were higher.

8. Better Plan

The 15-year mortgage offers a better plan for the average borrower. The policies and norms, such as the 30-year mortgage, which are designed and marketed to help lower income people, or people that need lower payments, traps them in a cycle of debt and interest payments. And it does so, right when they are growing as a family, young, and not in a position to be strapped financially.

9. Get 15 years of your life back

The beautiful thing about a 15-year mortgage is that it pays off in 15 years. That is 15 less years of a mortgage payment, 15 more years of freedom, and 15 more years that you can take that mortgage payment and invest in order to build your net worth.

10. Lower overall upkeep costs

If you do not happen to overborrow, and you secure a lower priced home with a 15-year mortgage, you will benefit from lower costs for upkeep, property taxes, and insurance. While this may sound small, it can really matter over the course of 10 to 15 years.

So there you have it. Those are the 10 reasons why you should choose a 15-year mortgage over a 30-year mortgage, for the sake of your long-term money goals.

Comments